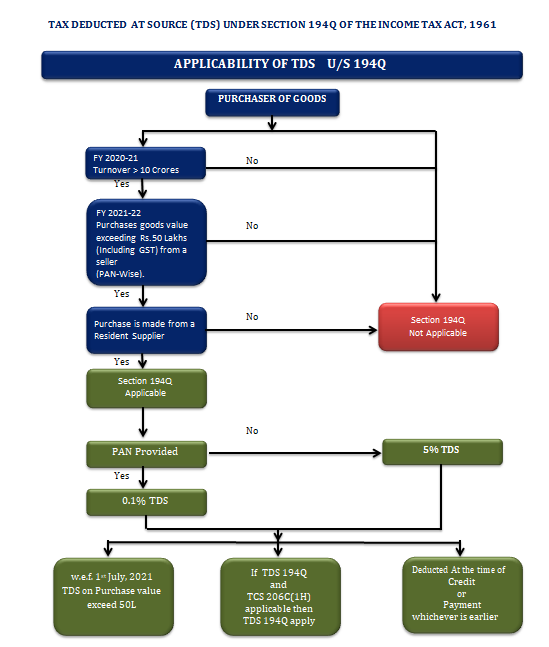

Finance Act 2021 has introduced a new section 194Q TDS on purchases of Goods which shall be effective from the 1st day of July, 2021

WHO WILL DEDUCT TDS

Purchaser will be liable to deduct TDS if-

- His Turnover during last year exceeds Rs.10 crores.

AND

- Purchaser purchases of goods of value exceeding Rs.50 Lakhs (Including GST) in the current year from a Seller (PAN-Wise).

AND

- Purchase is made from a Resident Supplier.

TIME OF DEDUCTION OF TDS

Tax to be deducted at the earliest of the following dates:

- At the time of credit of such sum to the account of the seller

or

- At the time of payment thereof by any mode,

RATE OF TDS

- Buyer of all goods will be liable to deduct tax at source

- @ 0.1% of sale consideration

- exceeding INR 50 Lakhs in a Financial Year

- Tax to be deducted @ 5%

- if the seller does not provide PAN

NON-COMPLIANCE OF THIS SECTION

- If purchaser fails to deduct TDS, 30% of the expenditure will be disallowed.

NO REQUIREMENT OF TDS UNDER THIS SECTION

- if TDS is deductible under any other provision

or

- TCS is collectible under section 206C [excluding 206C(1H)]

TDS U/S 194Q or TCS 206C (1H)

- TDS u/s 194Q will apply

and

- TCS u/s 206C(1H) will not apply

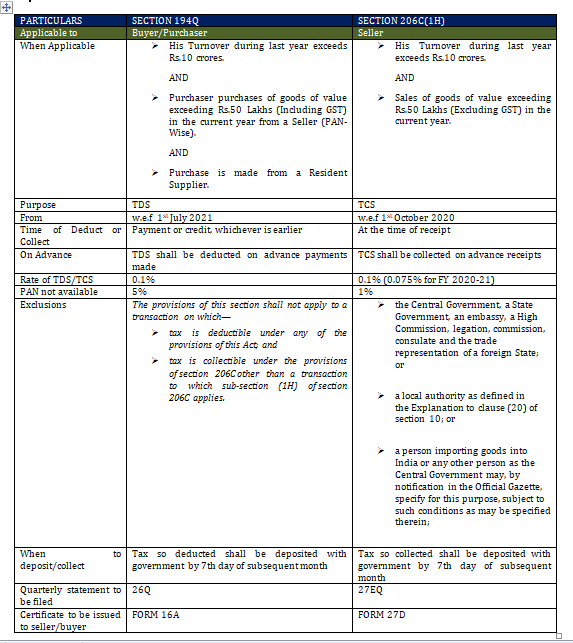

COMPARISON OF SEC 194Q AND 206C(1H) OF INCOME TAX ACT, 1961

https://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx