As per notification no. 40/2017-central tax (rate) and 41/2017-central tax (rate) both dated 23.10.2017, the registered supplier would supply the goods to the registered recipient on a Tax Invoice charging GST as follows :

- In case of intra-state supply – CGST is payable @0.05% and SGST is payable 0.05%

- In case of inter-state supply – IGST is payable @0.1%

CONDITIONS FOR AVAILING EXEMPTION

Following are the conditions to be satisfied for availing benefit of concessional rate of GST on supply to a merchant exporter:

- Supplier shall supply goods under a tax invoice

- Goods must be exported within a period of 90 days from the date of issue of tax invoice by the supplier. The exemption would not be available to the supplier if the merchant exporter fails to export the said goods within a period of 90 days from the date of issue of tax invoice

- Merchant exporter shall indicate the GSTIN of the supplier and tax invoice number issued by the supplier in the shipping bill/ bill of export

- Merchant exporter must be registered with an Export Promotion Council or a Commodity Board recognized by the Department of Commerce

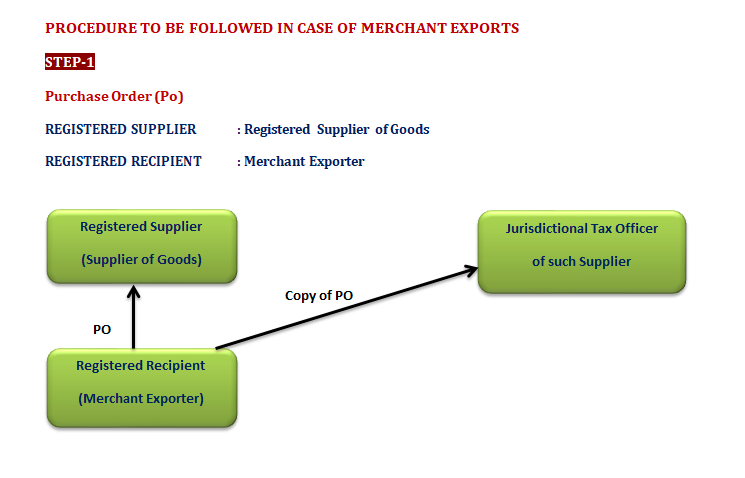

PROCEDURE TO BE FOLLOWED IN CASE OF MERCHANT EXPORTS

AFTER THE GOODS ARE EXPORTED:

- Copy of shipping bill/ Bill of export (incorporating supplier’s GSTIN)

- Tax invoice provided by supplier

- Export General Manifest/ Export report

Circular No. 37/11/2018-GST Dated 15th March, 2018:

SUPPLIES TO MERCHANT EXPORTERS:

Notification No. 40/2017 – Central Tax (Rate), dated 23rd October 2017 and notification No. 41/2017 – Integrated Tax (Rate) dated 23rd October 2017 provide for supplies for exports at a concessional rate of 0.05% and 0.1% respectively, subject to certain conditions specified in the said notifications.

It is clarified that the benefit of supplies at concessional rate is subject to certain conditions and the said benefit is optional. The option may or may not be availed by the supplier and / or the recipient and the goods may be procured at the normal applicable tax rate.

It is also clarified that the exporter will be eligible to take credit of the tax @ 0.05% / 0.1% paid by him. The supplier who supplies goods at the concessional rate is also eligible for refund on account of inverted tax structure as per the provisions of clause (ii) of the first proviso to sub-section (3) of section 54 of the CGST Act.

It may also be noted that the exporter of such goods can export the goods only under LUT / bond and cannot export on payment of integrated tax. In this connection, notification No. 3/2018-Central Tax, dated 23.01.2018 may be referred.