PAYMENT TO SUPPLIER / CREDITORS ON TIME TO CLAIM DEDUCTION

Finance Act, 2023 incorporate a new clause (h) has been added to Section 43B to provide that any sum payable to a micro or small enterprise beyond the time limit specified in Section 15 of the MSMED Act 2006 shall be allowed as a deduction on a payment basis.

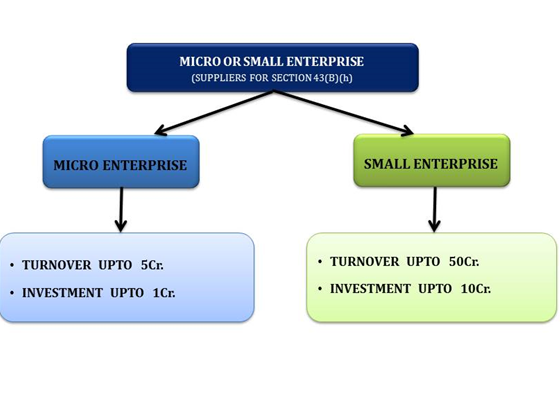

MICRO OR SMALL ENTERPRISE

After 14 years since the MSME Development Act came into existence in 2006, a revision in MSME definition was announced in the Atmnirbhar Bharat package on 13th May, 2020. As per this announcement, the definition of

- Micro manufacturing and services units was increased to Rs. 1 Crore of investment and Rs. 5 Crore of turnover.

- The limit of small unit was increased to Rs. 10 Crore of investment and Rs 50 Crore of turnover.

TIME LIMIT FOR MAKING PAYMENT TO CREDITORS (MICRO OR SMALL ENTERPRISE)

Section 15 of the MSMED Act 2006: Where any supplier, supplies any goods or renders any services to any buyer, the buyer shall make payment therefor on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.

From the above we can conclude that the payments to the MSME should be made maximum within 45 days and too after a format written agreement or else within 15 days.

NOTE:

- If the payment is due for more than 45 days or 15 days as specified but the payment is made before the end of the Financial Year – then in such case, the deduction of the expense will be available in the same year itself.

- If the payment is made after 45 days or 15 days as specified – then in that case the deduction will be available in the year in which the payment is made.