TAX COLLECTION AT SOURCE (TCS) UNDER SECTION 206C (1H) OF THE INCOME TAX ACT, 1961

w.e.f. 1st October, 2020

Finance Act, 2020 inserted sub-section (1 H) in section 206C of the Act which mandates that with effect from 1 st day of October, 2020 a seller receiving an amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year to collect tax from the buyer a sum equal to 0.1 per cent of the sale consideration exceeding fifty lakh rupees as income-tax. The collection is required to be made at the time of receipt of amount of sales consideration.

TCS u/s 206C (1H):

Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods being exported out of India or goods covered in sub-section (1) or sub-section (1F) or sub-section (1G) shall, at the time of receipt of such amount, collect from the buyer, a sum equal to 0.1 per cent of the sale consideration exceeding fifty lakh rupees as income-tax:

Rate of TCS under section 206C (1H)

| Section | Nature of Receipts | Rate For FY 2020-21 | Rate For FY 2021-22 |

| 206C (1H) | Sales of Goods | 0.075% | 0.1% |

Seller under the provisions of section 206C (1H)

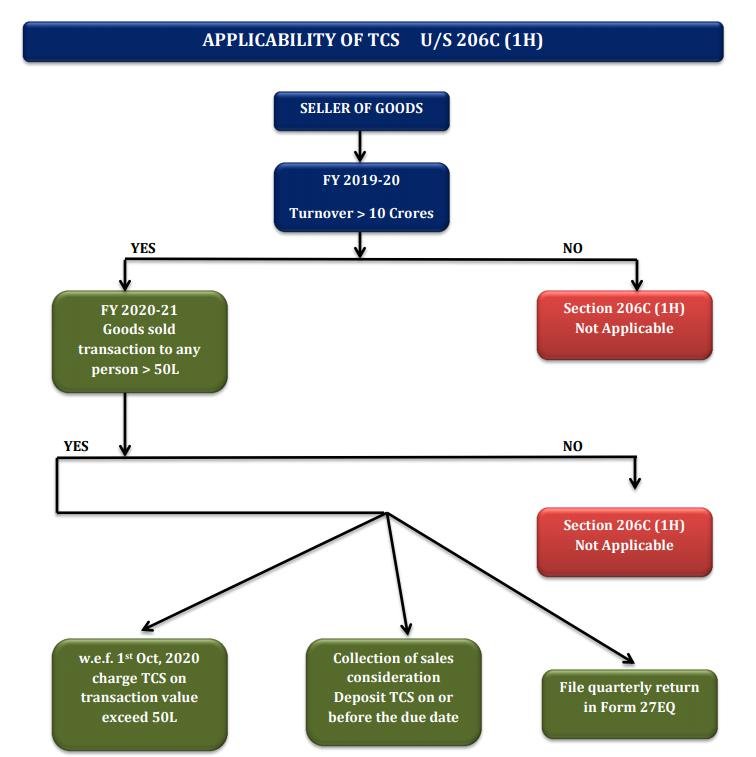

“Seller” means a person whose Total Sales/Turnover/Gross Receipts from the business being carried out by him in preceding financial year exceeds Rs. 10 Crores.

Buyer under the provisions of section 206C (1H)

“Buyer” means a person who purchases any goods,

but does not include,—

(A) the Central Government, a State Government, an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign State; or

(B) a local authority as defined in the Explanation to clause (20) of section 10; or

(C) a person importing goods into India or any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein;

Goods under the provision of section 206C (1H)

The term “Goods” has not been defined in the Income tax act and hence reference is made to Section 2(7) of the Sale of Goods Act, 1930 which defines goods to

“mean every kind of movable property other than actionable claims and money; and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale”.

For the purpose of Section 206C(1H), goods shall mean to include all goods as per above definition, however, the below goods shall be excluded since there are separate provisions u/s 206C for taxing these goods:

• Alcoholic Liquor for human consumption

• Tendu leaves

• Timber obtained under a forest lease

• Timber obtained by any mode other than under a forest lease

• Any other forest produce not being timber or tendu leaves

• Scrap

• Minerals, being coal or lignite or iron ore

• Motor vehicle (if value exceeds INR 10 Lakhs)

Apart from the above, even goods exported out of India shall be excluded.

Time of collection TCS

Section 206C (1H) specifically provides that the seller shall collect from the buyer a sum equals to 0.1% of the sales consideration at the time of receipt of such amount.

That means the liability to collect TCS will arise even in case of advance payment received though the goods will be physically delivered at a later date.

If Buyer has not provided the Permanent Account Number or the Aadhaar number to the seller

if the buyer has not provided the Permanent Account Number or the Aadhaar number to the seller, then the provisions of clause (ii) of sub-section (1) of section 206CC shall be read as if for the words “five per cent”, the words “one per cent” had been substituted i.e. (1%)

TCS will be charged either on CIF/ FOB amount

TCS has to be charged on Total Invoice Value after including all taxes, freight and other charges, hence TCS amount will be charged on a CIF basis.

TCS on Export of Goods

Goods exported outside India are not covered under this section. If the seller exports goods outside India then there will be not TCS. Also, if the seller sells goods and the buyer further exports goods outside India, then also TCS is not applicable. The only compliance here the seller has to complete is that the seller needs to obtain a declaration from the buyer that the goods will be exported.

Adjustment for sale return, discount or indirect taxes

No adjustment on account of sale return or discount or indirect taxes including GST is required to be made for collection of tax under sub-section (IH) of section 206C of the Act since the collection is made with reference to receipt of amount of sale consideration.

Applicability of TDS/TCS

If the customer is deducting TDS under the Income Tax Act on the transaction, the seller will not be liable to collect TCS u/s 206C(1H).

Illustration

https://www.incometaxindia.gov.in/communications/circular/circular_17_2020.pdf

https://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx